Islamic finance explained

By CPA Noor Nakato,

Technical Officer,

ICPAU

It is true that Islamic finance is named after the religion of Islam and that some of the world’s largest Islamic finance industries are domiciled in Muslim-majority countries like Saudi Arabia, Kuwait, United Arab Emirates, Qatar, Bahrain, Oman, and Malaysia. What is false, however, is that the industry is closed to those who do not profess the Islamic faith. The evidence of this is the existence of active and large-scale Islamic finance industries in Muslim-minority jurisdictions like the United States of America, the United Kingdom, Ireland, Italy, and sub-Saharan Africa.

The Islamic financial system allows for the exchange of funds between lenders, investors and borrowers in a way that meets the requirements of Islamic law (Shariah). Naturally, transactions that involve the payment or receipt of interest (riba), excessive uncertainty (gharar), and gambling (maisir) are prohibited by Islamic law. This prohibition also extends to involvement in sinful businesses such as prostitution, intoxicants, pornography, and the like.

THE ISLAMIC FINANCIAL ENVIRONMENT

Like its conventional counterpart, the Islamic financial system comprises banking and non-banking institutions as well as financial markets. Banking institutions include Islamic commercial banks, Islamic microfinance deposit-taking institutions, Islamic credit institutions, Islamic SACCOs, and Islamic payment systems. Takaful (Islamic Insurance) institutions, Islamic Pension Funds, Islamic Capital Markets, and Islamic Money Markets make up the non-banking institutions.

Islamic banking business

The conventional banking system treats money as a commodity that is lent to borrowers against interest as its compensation. Under this system, loans are extended to borrowers at a fee known as interest. Depositors in a conventional bank also receive interest on their deposits.

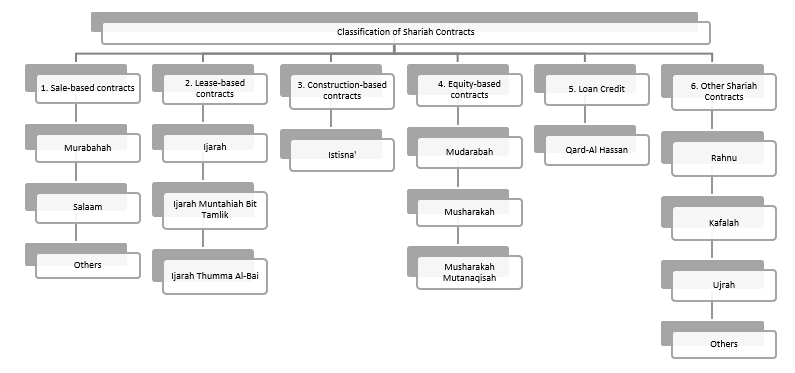

Islam, however, views money as merely a medium of exchange and not a commodity in itself. As such, loans and customer deposits in an Islamic bank do not accrue interest because it is prohibited to pay and receive interest on such borrowings. However, unlike interest, profit is permissible in Islam. The difference is that interest is a return from trading in money while profit is the return earned from trading and renting assets as well as business participation on a profit and loss basis. Islamic banking institutions, therefore, provide financing by entering into shariah-compliant contracts with their customers like cost-plus-markup financing (Murabaha), lease-based financing (Ijarah), partnership financing (Musharaka), interest-free loan financing (Qard-Al-Hassan), and equity financing (Mudharaba). These are illustrated in the figure below:

The ICPAU Financial Reporting Guidance for Islamic Banking Institutions (see www.icpau.co.ug) provides additional information on Islamic Banking.

ISLAMIC NON-BANKING BUSINESS

Islamic insurance (takaful)

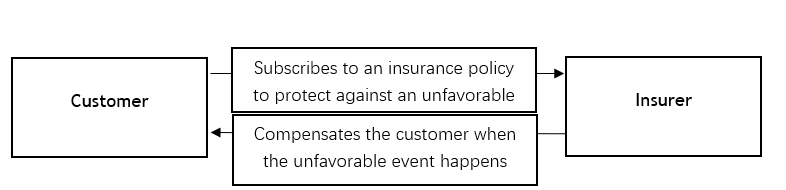

In conventional insurance, a customer (the policyholder) pays premiums to an insurance company (the insurer) to transfer to the insurer the risk arising from the occurrence of a future unfavourable event (the insured event). If the unfavourable event does not occur, the unused premiums are retained by the insurer and the policyholder has no claim on the same. If the unfavourable event occurs, the policyholder receives compensation, which is usually not equal to the premiums paid. The subject matter of a conventional insurance contract is usually uncertain until the unfavourable event has occurred. Also, the probability of occurrence of the unfavourable event is usually a gamble. All these characteristics render conventional insurance contradictory to the spirit of Islamic law (Shariah).

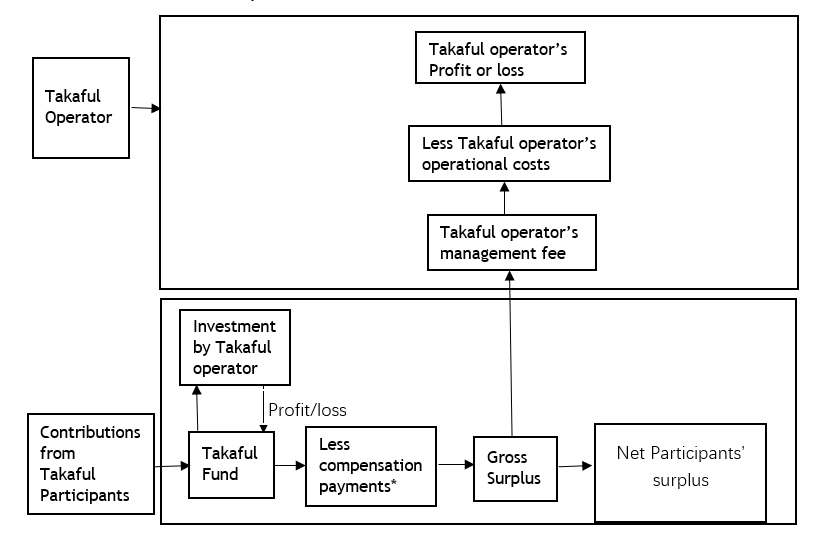

Takaful is the Islamically acceptable approach to insurance. A takaful operator sets up a takaful fund and invites participants to contribute to it. The participants undertake to contribute to a takaful fund and to indemnify each other against an agreed-upon unfavourable event in the spirit of mutual assistance. The takaful fund is managed by a takaful operator/insurer at a management fee that is determined based on one or more of the shariah contracts illustrated earlier in this article. The takaful funds are recorded and managed separately from the takaful operator’s capital and reserves. As the fund manager, the takaful operator is required to grow the fund by participating in shariah-compliant investments. The profits or losses generated from these investments are channeled back into the takaful fund.

If the insured unfavourable event occurs, compensation payments are made to the affected participant(s) from the takaful fund. At the end of the insurance period, the surplus in the takaful fund may be distributed to the participants or adjusted against the contribution due in future periods. In takaful, therefore, the unused premiums are owned by the participants and not the takaful operator/insurer, as illustrated in the example below:

* If the compensations payable exceed the amount available in the takaful fund, the takaful operator is required to extend an interest-free loan (Qard) to the fund, equal to the amount of the deficit. Such a loan is recoverable from future surpluses of the fund, as per the agreed terms and conditions.

The ICPAU Financial Reporting Guidance for Takaful Operators provides additional details on takaful.

Islamic Money Markets and Islamic Capital Markets

In a typical capitalist economy like Uganda’s, financial markets exist to provide avenues for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives between Surplus Spending Units (SSU) and Deficit Spending Units (DSU).

SSUs are units that have excess cash such as households through savings, pension funds, insurance companies, and non-financial companies; while DSUs are units that need money to put it to productive use, such as companies, and governments that required financing for infrastructure investments and operating expenses. Businesses and investors go to financial markets to raise money to grow their businesses and make more money.

Financial markets are categorised into money markets and capital markets. Money markets are financial markets wherein assets of short-term maturity and open-ended funds are traded between institutions and traders. Capital markets, on the other hand, are financial markets that allow for the trading of funding instruments such as shares, debentures, debt instruments, and bonds between individuals, firms, and governments. The securities exchanged in a capital market are typically long-term investments with a maturity period of more than a year. On the other hand, short-term investments with a maturity period of less than a year are usually traded in the money market.

The purchase and sale of financial instruments in Islamic Money Markets and Islamic Capital Markets is generally permitted by Islamic law. However, to achieve shariah compliance, avoid trading in financial instruments of companies involved in prohibited activities such as gambling, and other sinful business activities as detailed earlier in this article.

Papers 7, 8, 12, and 15 of the 2023 CPA Syllabus require students to demonstrate an understanding and appreciation of the characteristics and components of an Islamic financial system, as well as the distinction between Islamic and conventional modes of finance. The highlights presented in this article will help students to achieve this objective, and make them more relevant in the modern financial services space.